It's often said you can judge a country by how it treats its children. They are the most vulnerable and weakest members of every society, but they are also its future.

By that standard, the US fails.

The latest example of this failure is Central Falls, Rhode Island. Thanks to the magic of No Child Left Behind -- that domestic-educational version of the colonial war on Afghanistan, designed to stigmatize and punish poor students in every way conceivable -- every teacher in the town has been fired:

Every Central Falls teacher fired, labor outraged

The alleged reason for the firings: low test scores. This, of course, is a crock of stinking neoliberal horse$%^.

How exactly are these kids supposed to learn, when 25% of them are in families just barely scraping by on foodstamps? How are these schools supposed to function without enough books, teachers and materials? For thirty years, neoliberal governments have underfunded our K-12 system, slashed teacher salaries, and refused to pay for infrastructure.

I still remember my shock in 2004-2005 at discovering just how badly the K-12 classrooms had deteriorated in places like Eugene, Oregon and San Jose, California. These were not poor neighborhoods: Eugene is a university town and San Jose has the wealth of Silicon Valley. But there was no trace of that wealth in the schools. Art teachers had been laid off; class sizes were 35-40; textbooks were years out of date. And this was *before* the economic meltdown.

It doesn't have to be this way. We have the money, it's just that we spend $1 trillion every year on a wasteful and useless war machine. We piss away our national wealth by bombing, blasting and invading countries which never attacked us and don't threaten our security. We maintain 750 unnecessary overseas military bases, outfitted with satellite TV, internet, food courts and other amenities which most US schools would give their right arm to have. And we arm ourselves to the teeth against Cold War enemies who don't exist anymore -- Russia is a stable democracy, while China is one of our biggest trading partners and is undergoing significant democratization.

There's only one enemy which is threatening to destroy America: our own imperial stupidity.

Thursday, February 25, 2010

Tuesday, February 16, 2010

Free Your Texts, And Your Mind Will Follow

One of the most unpleasant aspects of my day job is running constantly into the copyright fundamentalism of the print media. Over and over again, I find journals are unavailable, books are locked down, and articles are sequestered by idiotic copyright restrictions. The economic downturn has made things even worse, because publishers are frantically locking down everything they can get their tentacles on, in the vain hope this will somehow resuscitate their broken business models. All it ever does is restrict access to texts to super-rich neoliberal elites, which is precisely what those elites want, of course.

Other commercial interests are now trying to turn text-distribution into yet another corporate pigopoly. Their dream is to do to print what cellphone companies have done with text-messaging: technically speaking, it costs carriers almost nothing to send text-messages, but they routinely charge you 10 cents per message. There's no law to stop them, and US telcos routinely buy off Congress through hundreds of millions of dollars of campaign donations and lobbying.

Fortunately, the data requirements for storing text are far lower than music or video, so time -- a polite way of saying, the ever-evolving digital commons, plus the urgent need of the BRIC nations for English-language materials which are affordable to citizens with per capita incomes of less than $1000 per year -- is on our side.

Texts want to be free, just like information.

Other commercial interests are now trying to turn text-distribution into yet another corporate pigopoly. Their dream is to do to print what cellphone companies have done with text-messaging: technically speaking, it costs carriers almost nothing to send text-messages, but they routinely charge you 10 cents per message. There's no law to stop them, and US telcos routinely buy off Congress through hundreds of millions of dollars of campaign donations and lobbying.

Fortunately, the data requirements for storing text are far lower than music or video, so time -- a polite way of saying, the ever-evolving digital commons, plus the urgent need of the BRIC nations for English-language materials which are affordable to citizens with per capita incomes of less than $1000 per year -- is on our side.

Texts want to be free, just like information.

Sunday, February 14, 2010

Education for All

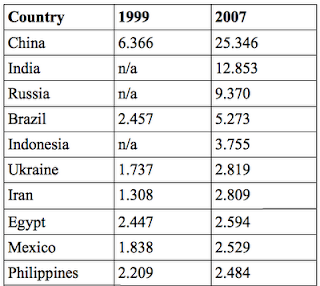

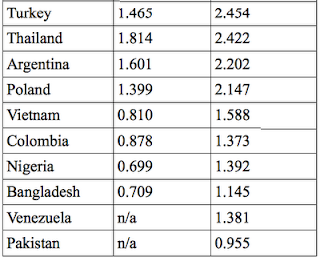

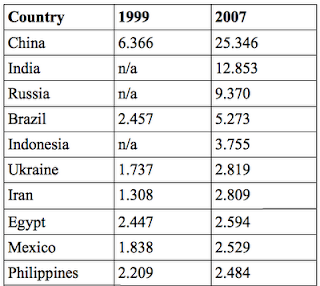

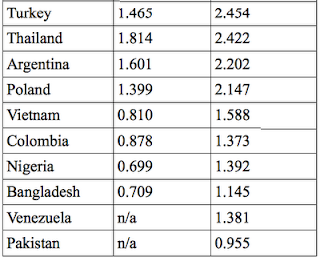

One of the most remarkable social changes of the post-neoliberal era has been the dramatic expansion of tertiary and higher education throughout the industrializing world. Here are the numbers from UNESCO's 2010 Education for All report on tertiary education around the world, measured in millions of students per country. Note that the BRIC countries are just the tip of the iceberg:

For the sake of comparison, note that the comparable US figure rose from 13.769 million in 1999 to 17.759 million in 2007. While the developing world is still far behind in per capita terms, it is catching up fast, and its vast student body has become one of the central drivers of its own unique forms of democratization, industrialization and mediatization.

For the sake of comparison, note that the comparable US figure rose from 13.769 million in 1999 to 17.759 million in 2007. While the developing world is still far behind in per capita terms, it is catching up fast, and its vast student body has become one of the central drivers of its own unique forms of democratization, industrialization and mediatization.

Saturday, February 6, 2010

2010: A BRIC Odyssey

Ever since the meltdown of the Wall Street bubble, the world has faced an $800 billion question.

This is a number with some history.

For decades, the US was the consumer of last resort in the world economy. We had the biggest GDP, and consumption was a huge share of our economy, rising from 64% in the 1970s to 70% today.

Of course, the US was consuming beyond its means. What that meant was that in 2007, when neoliberalism's house of credit cards finally imploded, the world faced an $800 billion shortfall in net consumer demand. Here's the math: US GDP $14.2 trillion x 70% consumption share = $9.94 trillion of consumption. US retail sales went up by 8% a year during the early 2000s, adding a fresh $800 billion in annual global demand.

However, the US consumer is deeply indebted and will be retrenching for years to come. So who will pick up the slack?

Enter the BRICs.

The BRICs have been combating the global downturn in two ways: through increased government spending (classic Keynesianism) and by shifting their economic model from savings and exports to a balance between savings and internal consumption (a.k.a. Digital Age developmental statism).

Here are the numbers:

China is running a government deficit of 2% of GDP, or $109 billion. While the economy has continued to expand, China has been spending heavily on education, infrastructure and healthcare to forestall a downturn. Meanwhile, retail sales hit $1.84 trillion last year, and are projected to grow 15% this year (an extra $280 billion). Total stimulus: $109 billion + $280 billion = $389 billion

Russia's government deficit hit $74 billion or roughly 5% of GDP in 2009. In addition to tax revenues going down -- Russia was hard hit by the drop in the price of oil, though it has recovered quickly -- the government is spending heavily on domestic consumption. Pension payments are going up, and money is flowing into education and the high-tech sector. Retail sales were around $400 billion last year, and sales should increase 6% this year (an extra $24 billion). Total stimulus: $74 billion + $24 billion = $98 billion.

India's government deficit increased from 3% of GDP to 7% last year, a swing of $48 billion. The reason was not economic crisis -- growth remained respectable -- but the government's decision to make long-overdue investments in infrastructure, rural development and education. Retail sales were about $427 billion last year, and growth rates are poised to hit 8% (an extra $34 billion). Total stimulus: $48 billion + $34 billion = $81 billion.

Brazil's government swung from a 3% budgetary surplus to zero, a swing of about $45 billion. Brazil's slowdown was mild, but the Lula government launched a bunch of infrastructure projects to spur demand. Retail sales were around $368 billion and should grow 8% growth this year (an extra $22 billion). Total stimulus: $45 billion + $22 billion = $79 billion.

Hey presto, the BRICs alone are going to create $647 billion of fresh demand this year. This isn't quite enough to counterbalance the US slowdown, but gets us close. If the EU and Japan continue their stimulus, the world will have found its post-American economic engine, and things will dramatically improve.

This is a number with some history.

For decades, the US was the consumer of last resort in the world economy. We had the biggest GDP, and consumption was a huge share of our economy, rising from 64% in the 1970s to 70% today.

Of course, the US was consuming beyond its means. What that meant was that in 2007, when neoliberalism's house of credit cards finally imploded, the world faced an $800 billion shortfall in net consumer demand. Here's the math: US GDP $14.2 trillion x 70% consumption share = $9.94 trillion of consumption. US retail sales went up by 8% a year during the early 2000s, adding a fresh $800 billion in annual global demand.

However, the US consumer is deeply indebted and will be retrenching for years to come. So who will pick up the slack?

Enter the BRICs.

The BRICs have been combating the global downturn in two ways: through increased government spending (classic Keynesianism) and by shifting their economic model from savings and exports to a balance between savings and internal consumption (a.k.a. Digital Age developmental statism).

Here are the numbers:

China is running a government deficit of 2% of GDP, or $109 billion. While the economy has continued to expand, China has been spending heavily on education, infrastructure and healthcare to forestall a downturn. Meanwhile, retail sales hit $1.84 trillion last year, and are projected to grow 15% this year (an extra $280 billion). Total stimulus: $109 billion + $280 billion = $389 billion

Russia's government deficit hit $74 billion or roughly 5% of GDP in 2009. In addition to tax revenues going down -- Russia was hard hit by the drop in the price of oil, though it has recovered quickly -- the government is spending heavily on domestic consumption. Pension payments are going up, and money is flowing into education and the high-tech sector. Retail sales were around $400 billion last year, and sales should increase 6% this year (an extra $24 billion). Total stimulus: $74 billion + $24 billion = $98 billion.

India's government deficit increased from 3% of GDP to 7% last year, a swing of $48 billion. The reason was not economic crisis -- growth remained respectable -- but the government's decision to make long-overdue investments in infrastructure, rural development and education. Retail sales were about $427 billion last year, and growth rates are poised to hit 8% (an extra $34 billion). Total stimulus: $48 billion + $34 billion = $81 billion.

Brazil's government swung from a 3% budgetary surplus to zero, a swing of about $45 billion. Brazil's slowdown was mild, but the Lula government launched a bunch of infrastructure projects to spur demand. Retail sales were around $368 billion and should grow 8% growth this year (an extra $22 billion). Total stimulus: $45 billion + $22 billion = $79 billion.

Hey presto, the BRICs alone are going to create $647 billion of fresh demand this year. This isn't quite enough to counterbalance the US slowdown, but gets us close. If the EU and Japan continue their stimulus, the world will have found its post-American economic engine, and things will dramatically improve.

Subscribe to:

Comments (Atom)